One of the things that has helped Equitable be the #1 RILA carrier in the industry in 2023 is the fact that your client can now win, even if they lose. Equitable’s Structured Capital Strategies Plus contract not only covers losses in your client’s account, it will cover the losses, and then credit the amount of the loss to your client’s account balance.

Sounds good, but what does it cost? Nothing.

Here is how it works.

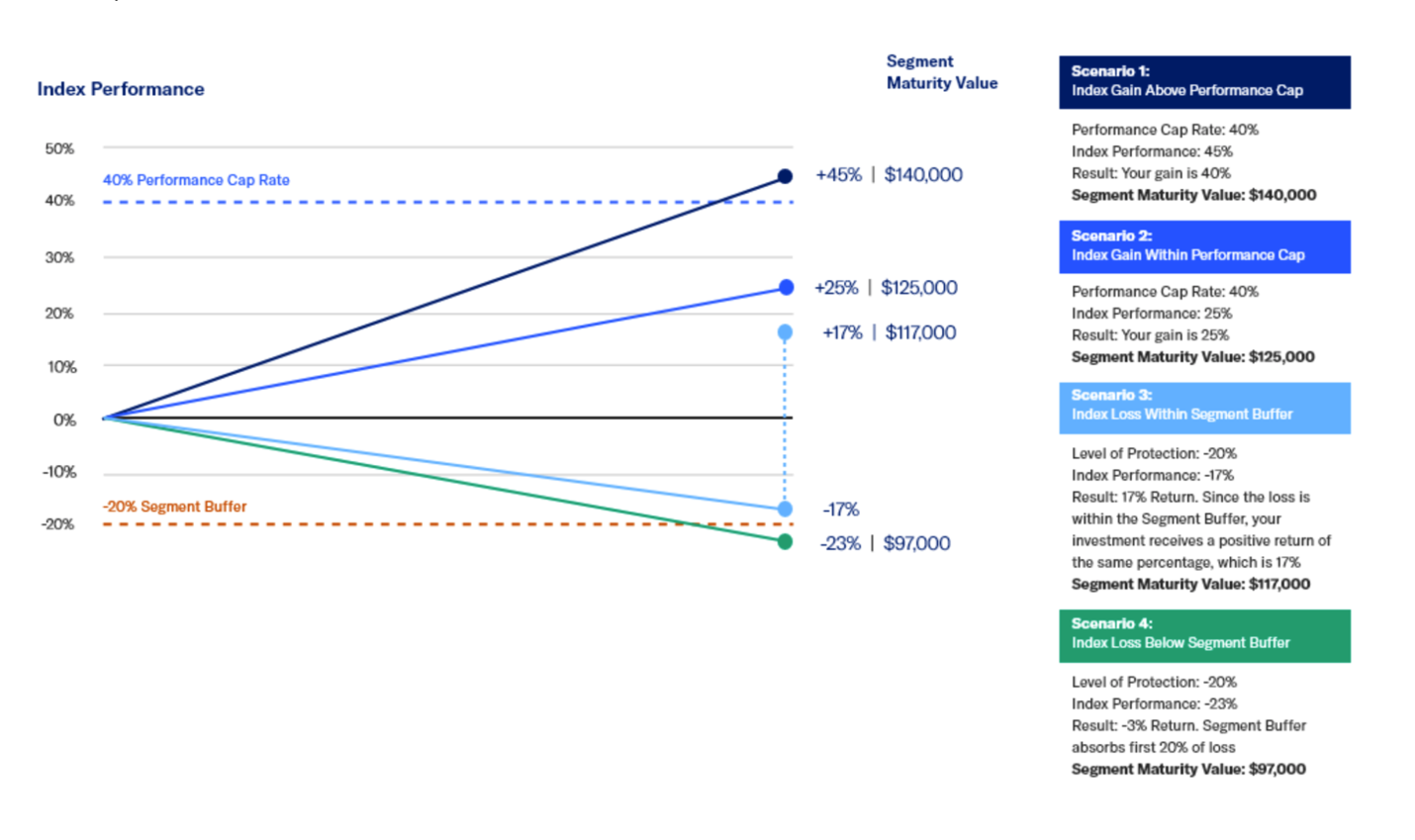

Like many other variable index annuity contracts, there is an investment term, indexes you can invest in, a buffer against losses, and a cap, all for no fees to the client. Where this product is different is not only does this contract provide a buffer, it also credits losses up to 20% back into the client’s account. For example, if the client invested $100,000 into the six-year term contract with the 20% buffer against losses option and at the end of the term the account value had dropped by 20%, the value of the account would be $120,000. This is because Equitable would be responsible for covering the first 20% of losses in the account because of the 20% buffer option selected, and then they would credit the amount of the loss back into the client’s account.

Please see the hypothetical illustration below. This hypothetical illustrates four different scenarios of how the six-year 20% dual direction segment (they also offer 10% and 15% dual direction segment options with higher caps) would work assuming a $100,000 investment. These are not the actual cap rates of the 20% segment option (current cap is 115%), it is just an example to illustrate how this contract will work in different situations.

To learn more about the Structured Capital Strategies Plus contract, please give me a call, or you can contact the Equitable sales desk at (888) 517-9900.