As time goes on, the everchanging RILA market grows stronger and stronger in its offerings. From Athene’s “large bonus” on any earnings in the account to Equitable’s “not only will we credit back your losses, but we will also add them as a gain,” the offerings just keep getting better and better. If you are not familiar with these two offerings, continue reading for a brief explanation of each.

First, the Athene Amplify contract. When thinking about the Athene Amplify contract, I like to think about looking at returns through a magnifying glass, and what does a magnifying glass do? It makes things larger than they would otherwise be if you were not using a magnifying glass. That is exactly what the Athene Amplify RILA product does as it pertains to the returns in the account – it makes them larger than they would otherwise be if not using the Athene Amplify “magnifying glass.”

The Athene Amplify product is not your typical RILA product. Like other RILA products, the Athene Amplify contract gives you upside potential with downside protection. The difference is that the upside potential in the Amplify contract is where we can bust out the magnifying glass. For example, right now you can build the contract to participate in the S&P 500 Index with no cap, a 130% upside participation rate, and you have a 20% buffer built in to protect against losses.

This specific build is a six-year point-to-point term like many other variable index annuities out there, but I want to be clear about one thing that initially slipped by me because I was used to the way just about all other variable index annuities work: The 130% is not a cap. The design I mentioned above is an uncapped design. The contract is giving you 130% of your index returns and a downside protection of 20%. In comparison, where other variable annuities may give you a cap of around 300%-500% growth right now on 20% downside protection, Athene’s Amplify contract will not cap that growth, and it will add 30% to whatever that uncapped growth number is.

Is this too good to be true? No, but it is too good to be free, and that takes us to a second difference between the Athene Amplify contract and most other variable index annuities. The Athene Amplify contract described above does carry a 0.95% annual charge. So, I guess you would have to ask yourself one question when considering a variable index annuity: Do you want one with no explicit fees to the client, or is 0.95% a year worth an extra 30% added to your earnings?

Now, let’s look at a design option in Equitable’s Structured Capital Strategies Plus RILA contract and what impact losses have on the account.

Can losses in your client’s account be a good thing for their overall account balance? The answer may surprise you. Equitable’s Structured Capital Strategies Plus contract not only covers losses in your client’s account, it will cover the losses and then credit the amount of the loss to your client’s account balance.

Sounds good, but what does it cost? Nothing.

Here is how it works.

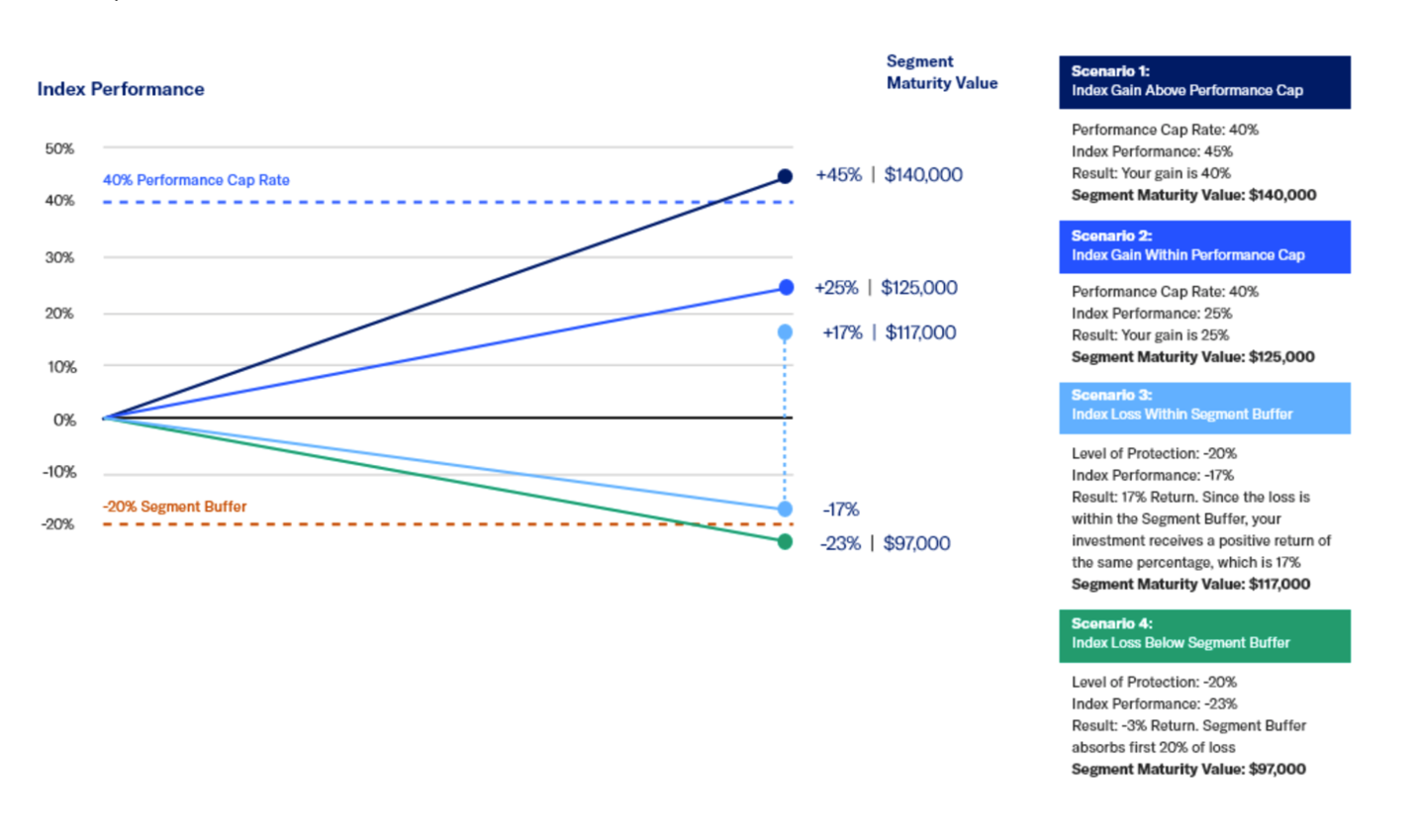

Like many other variable index annuity contracts, there is an investment term, indexes you can invest in, a buffer against losses, and a cap, all for no fees to the client. Where this product is different is not only does this contract provide a buffer, it also credits losses up to 20% back into the client’s account. For example, if the client invested $100,000 into the six-year term contract with the 20% buffer against losses option, and at the end of the term the account value had dropped by 20%, the value of the account would be $120,000. This is because Equitable would be responsible for covering the first 20% of losses in the account because of the 20% buffer option selected, and then they would credit the amount of the loss back into the client’s account.

Please see the hypothetical illustration below. This hypothetical illustrates four different scenarios of how the six-year 20% dual direction segment (they also offer 10% and 15% dual direction segment options with higher caps) would work, assuming a $100,000 investment. These are not the actual cap rates of the 20% segment option (current cap is 150%), it is just an example to illustrate how this contract will work in different situations.

If this is your first taste of the RILA market, I would encourage you to grab the full menu and take a closer look at why RILAs are one of the fastest-growing segments of the market today. This is a rapidly growing segment of the market, and financial professionals are finding that RILAs are a great fit for mutual fund clients that are concerned about the volatility in the market but still like the idea of market participation with the addition of downside protection. RILAs are also a good fit for clients in fixed annuities, fixed index annuities, and bond funds that are looking for a little more in returns than they are currently getting, while maintaining some downside protection.

To take a closer look at the RILA options offered through The Leaders Group, please see the attached “RILA: History and Landscape” brochure. If you would like to speak in more detail about the RILA market, please give me a call. Thanks!